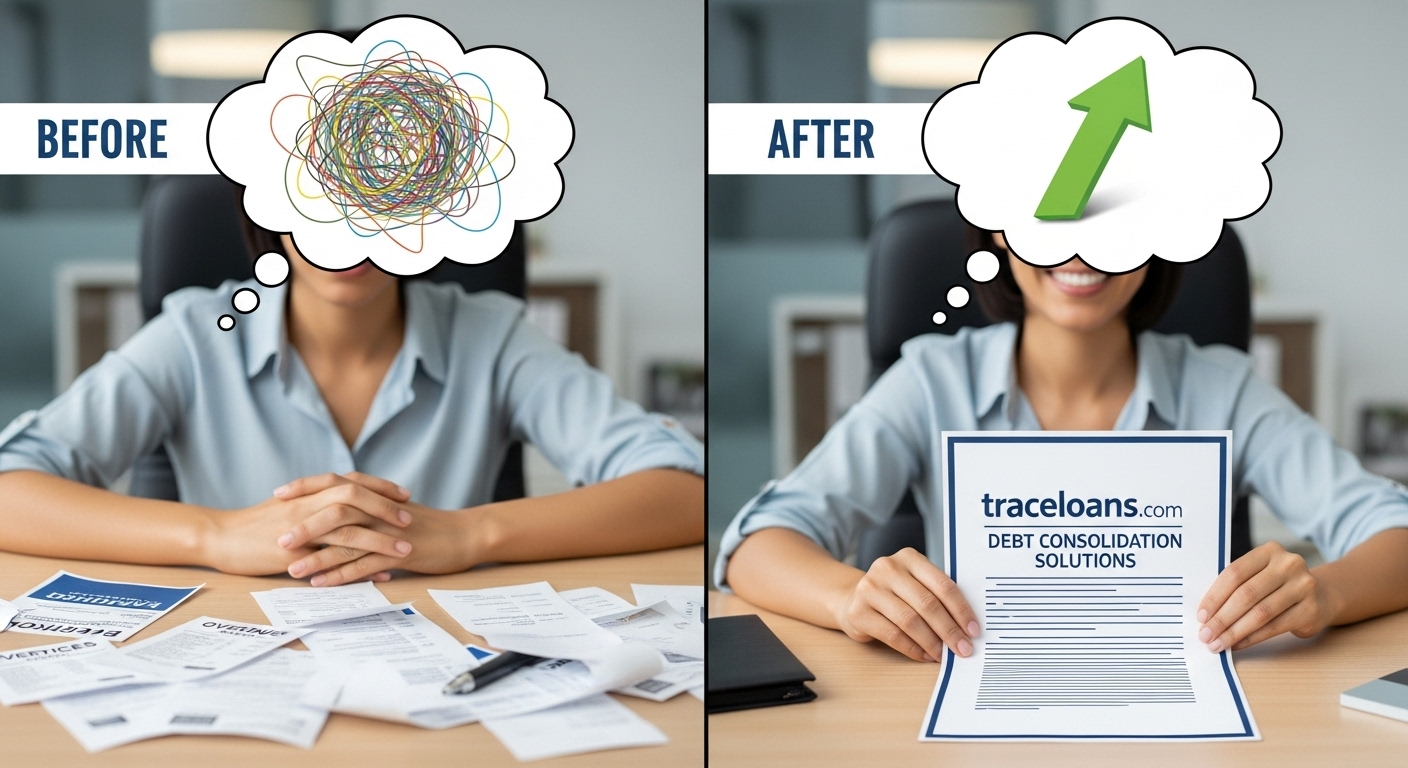

Debt can feel like an insurmountable mountain, weighing heavily on your shoulders and clouding your financial future. Many people find themselves juggling multiple payments each month, struggling to keep up with high-interest rates and due dates. The good news is that there’s a way out: debt consolidation. By consolidating your debts into one manageable payment, you can regain control of your finances and pave the way for a brighter tomorrow.

At traceloans.com, we specialize in providing personalized debt consolidation solutions tailored to meet individual needs. With our expertise and resources, transforming your financial landscape becomes attainable. Ready to explore how traceloans.com Debt Consolidation Solutions can change the course of your financial journey? Let’s dive into what makes this approach effective and beneficial for so many!

Benefits of Consolidating Your Debt with traceloans.com

Consolidating your debt with traceloans.com opens doors to financial freedom. By combining multiple debts into a single loan, you simplify your monthly payments. This means less stress managing various due dates.

With potentially lower interest rates, you can save money over time. Lowering the amount of interest paid allows more funds for essentials or savings.

Traceloans.com offers personalized solutions tailored to your situation. Their user-friendly platform ensures that finding the right plan is straightforward and efficient.

Additionally, consolidating debt can improve credit scores in the long run by reducing overall credit utilization. A healthier score paves the way for better borrowing options in the future.

Having one manageable payment instead of several can lead to increased peace of mind and financial clarity. Embrace a brighter financial future with this approach today!

How traceloans.com Works

Traceloans.com simplifies the debt consolidation process. It starts with a quick online application, where you provide details about your current debts and financial situation.

Once submitted, their team reviews your information to tailor a solution that fits your needs. They analyze factors like interest rates and monthly payments to create a personalized plan.

After approval, traceloans.com connects you with lenders who can offer competitive rates for consolidating your debts into one manageable loan. This means fewer monthly payments and reduced stress.

Throughout the process, customer support is readily available to address any questions or concerns. You’re not alone as you navigate this transformative journey toward financial stability.

With clarity on how they operate, you’re empowered to make informed decisions about your debt management strategy.

Success Stories of Clients Who Used traceloans.com for Debt Consolidation

At traceloans.com, countless clients have transformed their financial situations through effective debt consolidation solutions. Take Sarah, for instance—she faced overwhelming credit card bills that kept piling up month after month. After turning to traceloans.com, she found a manageable plan that significantly lowered her monthly payments.

Then there’s Mark, who struggled with multiple loans and high-interest rates. By consolidating his debts with the help of traceloans.com, he streamlined his finances and saved hundreds in interest fees. Now he can focus on saving for his future instead of worrying about looming payments.

These success stories are just a glimpse into the positive impact of using traceloans.com. Many individuals have regained control over their finances and discovered newfound peace of mind through tailored solutions designed to meet their unique needs.

Tips for Using traceloans.com Effectively

To make the most of traceloans.com Debt Consolidation Solutions, start by assessing your current financial situation. Gather all your debt information and understand how much you owe.

Next, use the online tools available on traceloans.com. They can help you visualize potential savings and repayment timelines. This will give you a clearer picture before making any commitments.

Stay organized throughout the process. Keep track of all communications with lenders and maintain accurate records of payments made.

Don’t hesitate to ask questions if something isn’t clear. The team at traceloans.com is there to support you, ensuring that you’re fully informed every step of the way.

Set up reminders for payment deadlines post-consolidation. Staying on top of payments will prevent future issues while also improving your credit score over time.

Alternatives to Consider When Consolidating Debt

When evaluating debt consolidation, exploring alternatives can provide valuable insights. One option is a balance transfer credit card. This allows you to move high-interest debt onto a card with a lower rate for an introductory period.

Another route is personal loans from banks or credit unions. These typically offer fixed rates and predictable monthly payments, making budgeting easier.

Debt management plans are also worth considering. Non-profit agencies can negotiate on your behalf, often securing lower interest rates and more manageable payment schedules.

For those facing severe financial difficulty, bankruptcy might be an avenue to explore. It’s critical to understand the long-term implications before choosing this path.

Peer-to-peer lending platforms have emerged as another alternative. They connect borrowers directly with investors looking to fund loans at competitive rates.

Each option has its own set of pros and cons, so it’s essential to assess what aligns best with your financial situation and goals.

Conclusion: Take Control of Your Finances with traceloans.com

Taking control of your financial situation is within reach with traceloans.com Debt Consolidation Solutions. By consolidating your debts, you can simplify payments, reduce interest rates, and ultimately alleviate financial stress. The benefits are clear—better management of your finances leads to peace of mind and a brighter future.

When you choose traceloans.com, you’re not just selecting a service; you’re opting for empowerment. Their streamlined process makes it easier than ever to navigate through debt challenges effectively. With real success stories from clients who have transformed their lives using these solutions, the potential for positive change is vast.

Don’t forget to utilize available resources and tips provided by traceloans.com. They can help ensure that you maximize the advantages of using their services while steering clear of common pitfalls associated with debt management.

If you’re still unsure about consolidation or looking at other options, it’s important to explore all avenues available for managing debt responsibly. This way, you’ll find the right solution tailored specifically for your unique circumstances.

Choosing traceloans.com could be the first step toward achieving financial freedom and stability. Your path forward starts today—embrace it fully!